UPDATE ON PUBLIC RULING NO. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

What Is An Investment Holding Company And When Is It Useful

82020 Taxation of a resident individual Part I - gifts or contributions and allowable deductions 4.

. On 152009 the tenancy of a major portion of the office lot ends and the. PR 102015 replaces Public Ruling 32011 PR 32011 on the same subject matter. Generally expenses incurred by a person prior to the commencement of his operations or business would not be allowable as a deduction against the.

It replaces PR No. An investment holding company IHC Not entitled unless the IHC is listed on Bursa Malaysia which is. The company is an investment holding company IHC.

INVESTMENT HOLDING COMPANY Public Ruling No. Great Bend KS GBRH Properties 2009 LLC 14 Interest RP SP 50001 - 100000 Partnership 15001 - 50000. The Inland Revenue Board IRB has issued Public Ruling no.

B Pre-Operation Business Expenditure. Unlisted Investment Holding Company IHC taxed under Section 60F is deemed to have no business income and it is not eligible for above special tax treatment and taxed at 24. 102015 on 16 December 2015 reported in the e-CTIM TECH-DT 872015 dated 21 December 2015.

19 December 2018. It works out the understanding that the Inland Revenues Director-General acquires information. 52019 - Perquisites from Employment which replaces Public Ruling no.

Nova Sdn Bhd closes its account on 31 December every year. Company or LLP without gross business income. Investment Holding Company by inserting additional explanations to paragraph 10.

However almost all PHCs maintain investment portfolios which may have significant tax implications. Therefore the holding company doesnt offer products or services but merely owns the shares of other corporations. 122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Investment holding entities NCM Bioscience Partners LLC Investment in Open Prairie Ventures II LP 3 Interest OT SP 50001 - 100000 Partnership None. 102015 Date Of Publication. In general a public ruling sets to explain the tax treatment structures that an investment holding company residing in Malaysia have to abide by.

INCOME FROM LETTING OF REAL PROPERTY Public Ruling No. Super Corridor MSC Status Company Rules 2006 PUA 2022006 effective year of assesment YA 2006 the letting of building in the Cyberjaya. We look at 4 benefits and 3 drawbacks to see if its suitable for you.

Investment holding companies not listed on BURSA Malaysia with profit from rent income subject to section 60F of the Income Tax Act 1967 ITA shall no longer be eligible for tax treatment under Paragraph 2A Part 1 of. Superseded by the Public Ruling No102015 16122015 - Refer Year 2015. 10 March 2011 Issue.

Public Ruling 102015 InvestmentHolding Company The IRB has issued Public Ruling 102015 Investment Holding Company PR 102015. Pioneer status or investment tax allowance Public Ruling No. 1967 a company which is an investment holding listed on Bursa Malaysia is deemed to have gross income from a business source and is eligible for tax treatment under paragraphs 2A or 2D Part 1 Schedule 1 and subparagraph 19A 3 Schedule 3 of ITA 1967.

Holding company for bank stock - Location. Moreover in the Practice Note the below salient points have been clarified. Basis Period For Business Non-Business Sources Companies Superceded by Public Ruling No.

Question 4 - Are pre-operational or pre-Commencement expenditure incurred by the company allowed to be deducted from the gross income of the business. CompanyLLP which does not have gross income from. It sets out the interpretation of the Director General in.

22013- Perquisites from Employment. 16 December 2015 Page 1 of 23 1. INLAND REVENUE BOARD OF MALAYSIA INVESTMENT HOLDING COMPANY Public Ruling No.

The above New Public Ruling can be viewed and downloaded from the IRBs website at the. Tax Incentive For Angel Investor. Rental income business is derived from the letting out of office lot in a 4-storey building.

CompanyLLP have no business income including those temporary closed but with other income which is. Now we understand why investment holding company is excluded from section 5 of the public ruling of income from letting of real property. Capital Allowance Industrial Building Allowance and the eligibility to claim against rental income.

102014 which was issued on 31 December 2014 and subsequently amended on 11 May 2016 see Tax Alerts No. This new 22-page PR replaces PR No. A personal holding company PHC is known as a C corporation formed for the purpose of owning the stock of other companies.

The Inland Revenue Board IRB has replaced the Public Ruling PR No. Company or LLP enjoying certain incentives or tax incentives eg. An investment holding company IHC means a company whose activities consist mainly in the holding of investments and not less than 80 of its gross income other.

A Page 6 of 25 Example 6. Objective The objective of this Public Ruling PR is to explain the tax treatment in respect of an investment holding company resident in Malaysia. Public Rulings New Public Rulings issued by the Inland Revenue Board of Malaysia.

82014 dated 1 December 2014 - Refer Year 2014. The summary of the PR is set-out below. To ensure that the public ruling is coherent and valid the Director-General will refer to Section 138A of the Income Tax Act 1967 ITA and its various rules.

2 Act 2014 to the following. Special Allowances for Small Value Assets dated 21 July 2021. 12020 Tax Incentives for BioNexus Status Companies The IRB has issued PR No.

An investment holding company IHC and the process of setting one up in Malaysia has created a lot of buzz. 32011 dated 10 March 2011. Public Ruling 12020 - Tax Incentives for Bionexus Status Companies Automation equipment incentives - Investment Allowance and Accelerated Capital Allowance Stamp duty exemption for restructuring or rescheduling of a business loan or financing Labuan entities carrying on pure equity holding activity - Full-time employees requirement.

It is issued mainly to update the contents of PR 32011 due to amendments made via Finance No. Relevant Provisions of the Law 21 This PR takes into account laws. Tax Year 2016 Form 990O.

102015 INVESTMENT HOLDING COMPANY The Inland Revenue Board of Malaysia IRBM issued Public Ruling PR No. Deduction of Interest Expense And Recognition of Interest Income For Loan Transactions. Nalc health benefit plan for employees and staff.

52019 - Perquisites From Employment. If your intention to create a company is to hold all your properties and enjoy the deductibles that individuals. The public ruling serves as a guide for both civilians and the officers representing the Inland Revenue Board of Malaysia.

The IRB has recently issued PR No.

Investment Management Retrospective 2020 S Second Half Insights Skadden Arps Slate Meagher Flom Llp

Determining Holding Period Upon Sale Of Rental Real Estate Dallas Business Income Tax Services

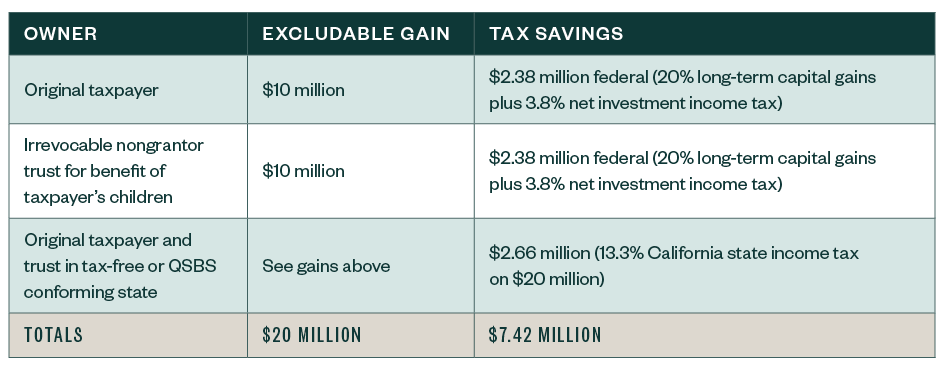

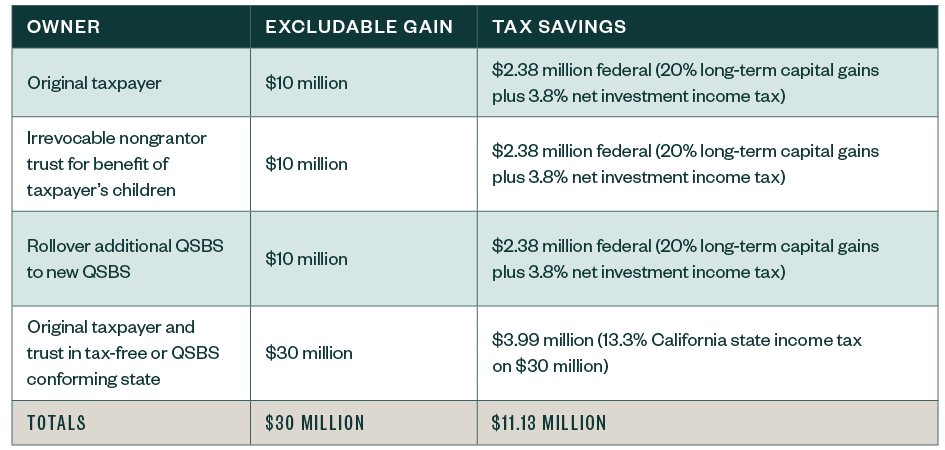

Qualified Small Business Stock Tax Benefits

What Is Investment Holding Company Ihc Anc Group

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Sec 199a And Subchapter M Rics Vs Reits

What Is An Investment Holding Company And When Is It Useful

What Is An Investment Holding Company And When Is It Useful

Stocks Owned By Supreme Court Justices Tilt The Scales Of Justice

F 1 A 1 A2242169zf 1a Htm F 1 A Use These Links To Rapidly Review The Document Table Of Contents Index To Consolidated Financial Statements Table Of Contents As Filed With The Securities And Exchange Commission On August 7 2020

Qualified Small Business Stock Tax Benefits

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

What Is Investment Holding Company Ihc Anc Group

What Is Investment Holding Company Ihc Anc Group

Establishing A Holding Company In Malaysia What Is Holding Company

Establishing A Holding Company In Malaysia What Is Holding Company

What Is An Investment Holding Company And When Is It Useful

What Is An Investment Holding Company And When Is It Useful